In all our consciousness, there is a lot to look forward to in the coming year(s) beyond technology. This blog is an attempt to summarize my learnings from the various seminars that I presented on intersection of blockchain, AI, and big data this year and where I believe the focus will be in upcoming years. There is a wealth of information online and in my blogs covering the basics of listed technologies hence not in scope of this blog.

I saw a maturity in my audience from beginners to seasoned investors, the goal being to get from the crypto craze hype to a discussion on core components of all these platforms. I believe this kind of understanding to be key as that is the differentiator and the intelligence one can gain in cryptocurrency centric markets.

Cryptocurrencies are beyond blockchain, for instance, IOTA uses “tangle”, which is based on a mathematical concept on directed acyclic graph to overcome limitations with the blockchain architecture. Regardless, the underlying strategy is to have a decentralized data platform and infrastructure conforming to the notion of trust and validity. IPDB, a planetary-scale blockchain database gets us closer to the big data characteristics of storage engines. BigchainDB being one such engine capable of holding the actual data and connect databases with interledger protocols for interoperability.

So, back to my topic of what to expect this coming year. Here are a few that I consider being upcoming enterprise level trends excluding developer tools.

Sharing data – multinational enterprise or making trusted data public: For an industry consortium, each company owns particular node or nodes to manage competition. Share single source of truth public data on an IPDB database. There are numerous benefits, including gaining new insights and increasing profitability from data monetization. Ocean protocol is one such project and with promising vibes.

Audit and Control – solving AML, KYC, and Double-spending. This will rely on the above and how real-time analytics will be applied to make decisions about pseudonymous data. This is an enabler and a measure to the adoption of blockchain in financial services firms. The maturity will occur from middle- and back-office internal processes. It is already begun in global financial services firms.

Intelligent Portfolio of Cryptocurrency – With a total market cap of $600B and 1400 coins/cryptocurrencies being traded, there is a need to understand the trends and influencers in this industry. I saw few products come up but are limited to few coins/tokens. This has been understood in depth and in a language, an average investor can understand. The prominent financial services firms de-risking out of cryptocurrency investment is creating a large population to use gray market or illicit means to participate in this economy. I would add AI driven DAO’s to this category as well.

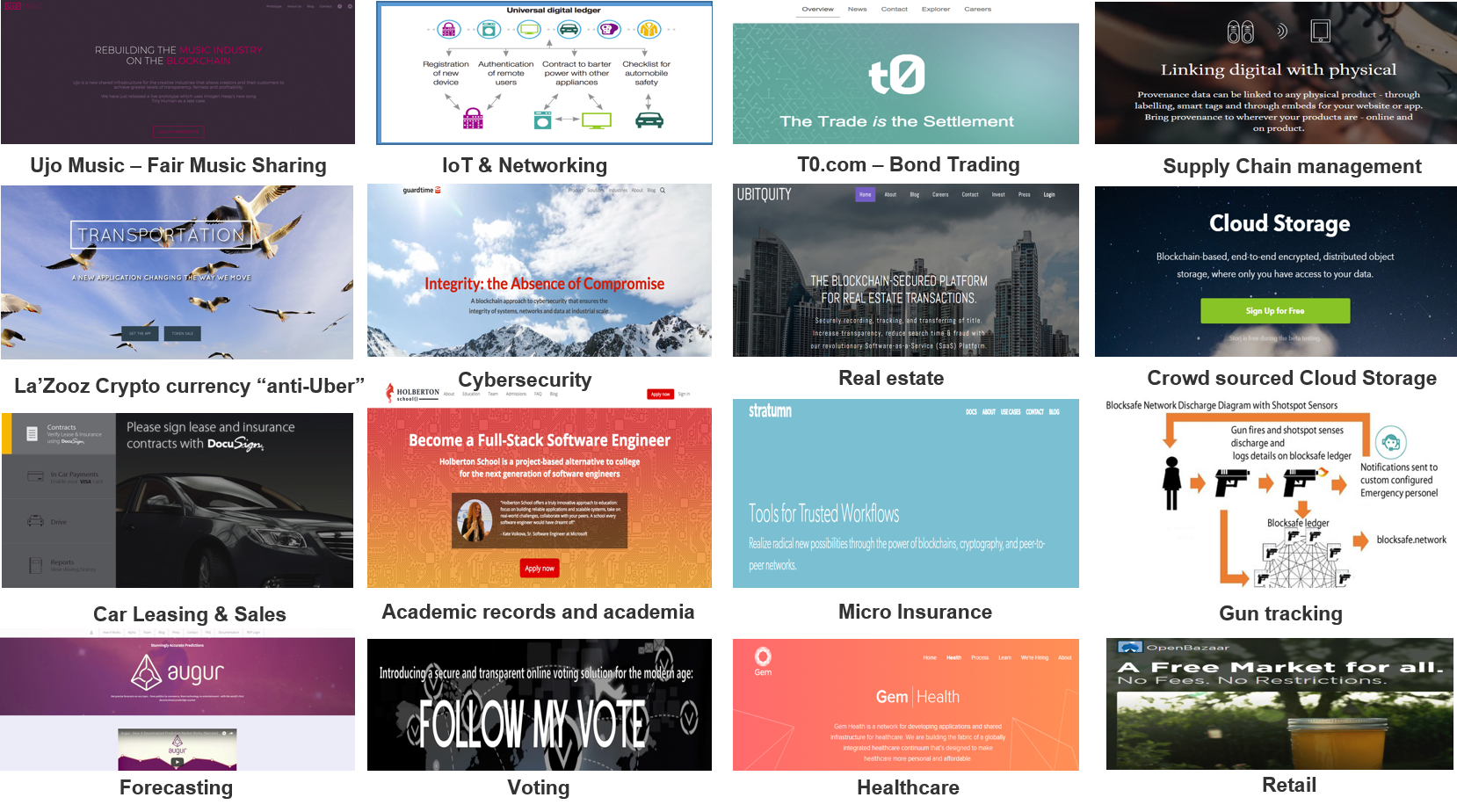

Expansion of Use Cases – We saw a variety of use cases for blockchain and I expect this to grow even further but now with a more regulated and informed approach that conforms to all of the above. Hoping to see traction in areas of public security and safety, and monitoring gray market.

Get Social